Elected U.S. Officials Leaving in Droves

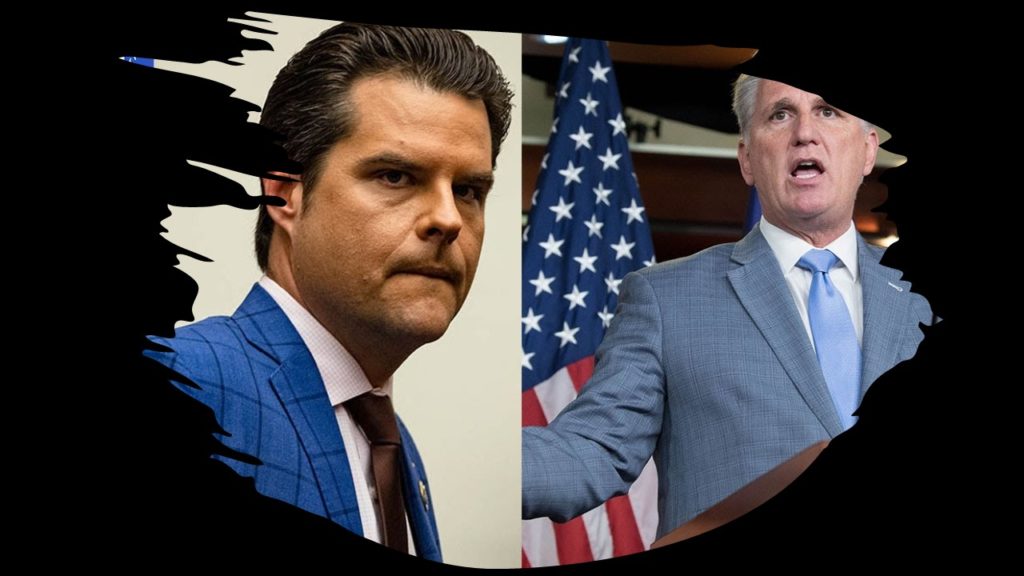

In 2023, several committees were established with the sole purpose of impeachment, leading to the eventual impeachment and removal of Speaker of the House, Kevin Mccarthy. Representative Gaetz spearheaded this effort. At present, in 2024, numerous elected officials have formally communicated their intention to not seek re-election.

Among the Senate members that are not running for re-election, six have retired from public office while one has expressed their interest in running for governor of Indiana. Of the 35 U.S. House members not seeking re-election, twelve aim to run for the U.S. Senate, two are running for state attorney general, one for governor, and one for the President of the United States. Moreover, 19 members, ten Democrats and nine Republicans, have decided to retire from public office.

These developments have been noted by concerned citizens of the United States. Now, more than ever, it is imperative that Patriots, Libertarians, Independents, and Undecided voters unite to elect representatives who uphold Christian values and the cherished principles of our Founding Fathers.

Source: List of U.S. Congress incumbents who are not running for re-election in 2024 – Ballotpedia

McCarthy Ousted, WHY?

On October 3, 2023, several notable events occurred that have caused a division in Congress. The civil trial of Donald Trump was presided over by a New York judge, while the House Republicans were pitted against each other, leading to chaos and confusion. The situation was worsened by Hunter Biden pleading innocent to a gun charge, and the border being in disarray. It is a regrettable situation that must be addressed with professionalism and political maturity.

Representative Ted Lieu of California commented on the House situation by stating, “It’s incredibly unfortunate that we’re in this situation, but the reality is Kevin McCarthy ran to the extremes at every possible turn from the very beginning. Hopefully, the Republicans will be able to put forward someone that doesn’t break his word and we’ll see what happens. I am voting for Hakeem Jeffries.”

Despite talk over the weekend that some Democrats might cut a deal with McCarthy to save him, the Speaker ultimately refused to offer members of the opposition party any concessions, leaving Democrats united against him. In the narrowly divided House, only a handful of Republicans needed to join Democrats to create the majority needed to win the vote. It was Rep Matt Gaetz of Florida who “motioned to vacate” Kevin McCarthy as Speaker of the House, leading to a divided Congress.

Gaetz orchestrated the effort of removal by filing a “motion to vacate,” sparked by McCarthy’s recent decision to work with Democrats to avoid a federal government shutdown.

What was the failure that caused Rep of Florida, Matt Gaetz to make a motion to vacate California Rep and Speaker of the House, Kevin McCarthy?

Previous Continuing Resolutions (Appropriations) proposals from Republicans did not get any support from Democrats. The Stopgap resolution was made at the 11th hour of its government shutdown deadline. Stopgap, if passed, would keep the federal government funded for the next 45 days. This would give the House more time. Gaetz and his crew did not want military funding made to Ukraine. The 71-page resolution includes a $16 billion disaster relief including adding $7 billion to aid Afghanistan evacuees, but no Ukraine military funding that Biden wanted. House lawmakers on both sides of the aisle broke out into applause in a rare moment of bipartisanship after the short-term bill known as a continuing resolution, passed 335 to 91.

Senate passage came by an 88-9 vote. Biden signed the bill on October 1, 2023.

The following House Republicans who voted to oust McCarthy along with every Democrat present:

- Andy Biggs of Arizona

- Ken Buck of Colorado

- Tim Burchett of Tennessee

- Eli Crane of Arizona

- Matt Gaetz of Florida

- Bob Good of Virginia

- Nancy Mace of South Carolina

- Matt Rosendale of Montana

After the historic vote Republican Representative Patrick McHenry is now serving as Speaker pro tempore.

The House is now more divided than ever, and the Senate is not expected to pass spending bills due to the Fiscal Responsibility Act capping funding levels. It is vital that both parties work together to avoid another continuing resolution and find a better solution for the country.

Here is gloat by Hakeem Sekou Jeffries who is a politician and attorney and who has served as Leader of the House Democratic Caucus and House Minority Leader since 2023.

“The American people have won. The extreme MAGA Republicans have lost,” Jeffries said at a press conference. “It was a victory for the American people and a complete and total surrender by right-wing extremists who throughout the year have attempted to hijack the Congress.”

Americans will continue to wait to see and try to be patient. Democrats brag victory and continue their platform of deceit, lies, propaganda and destroying our America. After all this division will anything really change. Takes all Patriots to be empowered and prepared.

The Patriot Post® · RNC: The Truth About Bidenomics

By Political Editors · July 28, 2023

https://patriotpost.us/articles/99222-rnc-the-truth-about-bidenomics-2023-07-28

Source: Republican National Committee

INTEREST RATES CONTINUE TO RISE

- Biden claims that Bidenomics is just another way of saying “restoring the American dream1,” yet his policies have made this dream increasingly out of reach2 for millions of hardworking Americans.

- In March, Biden Treasury Secretary Janet Yellen confirmed3 that Biden’s inflationary spending set the stage for higher interest rates.

- Because of Biden’s failed agenda, more and more Americans are struggling to take out a mortgage, finance a vehicle4, and perform various other financial transactions.

- Faced with higher interest rates, business plans are being put on ice5 and Americans are agreeing to loan terms that would have been unimaginable just a year ago.

- This is a direct result of Bidenomics – Biden fueled inflation, which forced the Fed6 to raise interest rates.

- Including today’s hike7, the Federal Reserve has now raised interest rates 11 times4 since March 2022 with the goal of lowering inflation.

- Interest rates are at their highest level in 22 years8.

- The cumulative effects9 of these interest rate increases are squeezing Americans’ finances and punishing5 the cash-poor.

- 61 percent10 of Americans said they took a financial hit due to rising interest rates in the past 12 months.

- Bidenomics has cost the middle class $2.4 trillion11 since March 2022.

- The average middle-class household has lost over $33,000 in real wealth11 in just the past year.

BIDENOMICS IS MAKING IT HARDER FOR FAMILIES TO BUY A HOME

- For many people, including Biden himself, “the aspiration to own a home is connected deeply to the American dream12.”

- Thanks to Bidenflation, working-class Americans face surging home prices13 and rising mortgage rates14, leaving many unable to afford buying a home.

- According to Freddie Mac, the average 30-year fixed mortgage rate has more than doubled15 since Biden took office, increasing from 2.77 percent to 6.78 percent.

- When a 30-year fixed mortgage still averaged 3.1 percent, a borrower could get a $700,000 mortgage for monthly payments of $2,989 – that same mortgage taken out at a rate of 6.9 percent would equal a $4,610 monthly payment, which is $583,000 more over 30 years16.

- Rising mortgage rates have caused homebuyers to lose $60,000 in purchasing power17 in just one year according to a recent report by Redfin.

- Homebuyers are increasingly being priced out of the market18, denying them the ability to build wealth19.

- Retiree Gary Deuvall of Mississippi20 said “We’d hoped to build or buy a house. But interest rates are so high, that’s on pause. Meanwhile, I’ll just rent.”

- On top of higher mortgage rates, the Biden administration wanted to punish responsible Americans21 by forcing borrowers with good credit scores to pay an additional fee in order to subsidize riskier22

- For families that cannot afford a house, rental options offer no protection from Bidenflation, with rent increasing 8.3 percent25 since last year.

- 73 of America’s 100 largest cities26 saw month-to-month rent increases in June.

OWNING A CAR IS BECOMING INCREASINGLY UNAFFORDABLE

- The cost of a new car continues to rise, with the number of car buyers paying $1,000 or more a month to finance a new vehicle recently reaching an all-time high27.

- Roughly one in three5 car buyers are now taking out six to seven-year loans on used vehicles to help lower monthly payments.

- In 2004, only 1 percent28 of auto loans lasted six to seven years.

- These buyers are forced to pay higher loan rates as a result the Fed’s interest rate hikes.

- The average loan rate9 in May was 7.1 percent for new car loans and 11 percent for used car loans – up from 5.1 percent and 8.2 percent a year earlier, respectively.

- High loan rates mean higher monthly payments, with the average monthly payment to finance a new car recently hitting the highest on record28.

- The average used car loan is now 125 percent29 of the car’s value, which can leave borrowers owing more30 on a car than its present market value.

- Higher rates are causing more drivers, particularly young drivers, to fall behind on their car payments31 according to a study by the New York Federal Reserve.

- According to Cox Automotive data, May’s severe delinquency rate32 was the worst since at least 200633.

- For those who can afford the average monthly payment of $736, they will pay nearly $9,000 in interest4 over the life of the average loan.

- Meanwhile, rejection rates for auto loans are rising – recently hitting their highest on record32 – as lenders become increasingly cautious.

- Americans who can afford a car must then face additional pain at the pump to fill up their tank, spending an average of over $1 per gallon34 more for gas compared to when Biden took office35.

- Roughly one in three5 car buyers are now taking out six to seven-year loans on used vehicles to help lower monthly payments.

CREDIT CARD DEBT IS PILING UP

- The Federal Reserve’s interest rate hikes have caused credit card rates to increase36 as well.

- When the federal funds rate rises, the prime rate follows suit37, which credit card companies then use to set their own interest rates.

- This means that cardholders who carry a balance month to month can expect higher credit card bills38.

- The average credit card interest rate is now the highest20 since Bankrate began tracking credit card interest rates in the mid-1980s.

- Credit card rates are one of the fastest ways20 higher interest rates hit consumers, because unlike car loans or mortgages that are fixed-rate, higher credit card interest rates get passed through “pretty much right away.”

- Meanwhile, credit card debt is already at a record high20, and more people are carrying debt month to month.

- Americans are increasingly relying39 on credit cards to help maintain their spending, and those who aren’t able to make ends meet “are just digging themselves a deeper and deeper hole with the higher interest rates5.”

HIGHER INTEREST RATES ARE IMPACTING STUDENT LOANS

- Hardworking Americans who want to pay off their student loans, as well as those thinking about going to college, are getting pummeled by these higher interest rates thanks to Biden.

- Borrowers of private student loans with variable rates have been directly impacted by the Fed’s decision to raise interest rates.

- Average interest rates40 on a 5-year variable-rate private student loan currently41 sit at 6.74 percent, up from 3.93 percent a year ago and up from a record low of 1.84 percent in 2021.

- While borrowers who already hold federal student loans are not affected by the Fed’s actions, new batches of federal loans will hold higher rates.

- Borrowers with federal undergraduate loans disbursed after July 1, 2023 will pay 5 percent9 – just three years ago, rates were below 3 percent.

- This is the highest level42 that most undergraduate borrowers have faced since 2013.

- Biden wanted to unilaterally cancel up to $10,00043of student debt per borrower, a handout to the rich that would have cost taxpayers who didn’t go to college billions and worsened inflation.

- According to the Penn Wharton Budget Model44, Biden’s student loan bailout “could [have] exceed[ed] $1 trillion,” with the majority of the benefits going to the top 60 percent of earners.

- The National Taxpayers Union Foundation45predicted that Biden’s bailout would have burdened the average taxpayer with roughly $2,500.

- Experts warn that Biden’s plan would have encouraged46 colleges to raise tuition even higher, making the problem even worse.

Post found on line #47.

Links

- https://www.whitehouse.gov/briefing-room/speeches-remarks/2023/07/06/remarks-by-president-biden-on-bidenomics/

- https://nypost.com/2023/07/04/the-american-dream-is-becoming-increasingly-out-of-reach-poll/

- https://gop.com/rapid-response/yellen-admits-inflation-broke-the-banks/

- https://apnews.com/article/federal-reserve-interest-rates-car-loans-cost-4fc4e26e7f8985ca98eef428d9525f29

- https://www.washingtonpost.com/business/on-small-business/highest-interest-rates-in-15-years-are-derailingthe-american-dream/2022/12/19/2a16b0ba-7f86-11ed-8738-ed7217de2775_story.html

- https://twitter.com/RNCResearch/status/1636388791756943363

- https://twitter.com/CNBCnow/status/1684262594989654025?s=20

- https://www.wsj.com/articles/federal-reserve-raises-interest-rates-to-22-year-high-3c3e499c?st=u81zv9r7cygvot8&mod=e2twp

- https://www.nytimes.com/2023/06/14/business/interest-rates-consumer-loans.html

- https://www.foxbusiness.com/personal-finance/high-interest-rates-finances-allianz

- https://www.bloomberg.com/graphics/2023-bidenomics-middle-class-economic-anxiety-2024-election/

- https://www.govinfo.gov/content/pkg/DCPD-202100461/pdf/DCPD-202100461.pdf

- https://www.cnbc.com/2023/07/10/home-prices-hit-new-highs-driven-by-tighter-supply.html

- https://apnews.com/article/mortgage-interest-rates-housing-loans-real-estate-94dd344bf67ded00f56e078a0fdec667

- https://www.freddiemac.com/pmms

- https://fortune.com/2023/07/19/mortgage-rates-housing-market-affordability-borrower-refinance-speculation/

- https://money.com/homebuyer-purchasing-power-down-mortgage-rates/

- https://www.realtor.com/homemade/78-of-home-shoppers-expect-to-be-priced-out-of-the-market-if-prices-rates-continue-to-rise/

- https://www.urban.org/urban-wire/rethinking-homeownership-american-dream

- https://apnorc.org/credit-card-debt-is-at-record-high-as-fed-raises-rates-again/

- https://www.usatoday.com/story/opinion/columnist/2023/05/04/biden-mortgage-rule-credit-score-cost-homebuyers-more/70179031007/

- https://mast.house.gov/2023/4/biden-continues-to-punish-hard-work

- https://www.nar.realtor/magazine/real-estate-news/nar-fhfa-heard-industry-loud-and-clear-on-proposed-fee

- https://www.youtube.com/watch?v=HlR4wLrPXlM

- https://twitter.com/byHeatherLong/status/1679113543499620355

- https://www.apartmentlist.com/research/national-rent-data

- https://www.freep.com/story/money/cars/2023/07/03/car-payments-inventory-interest-rates/70378655007/

- https://www.cnn.com/2023/04/15/cars/car-loan-interest-rates-2023-dg/index.html

- https://www.autoblog.com/2023/06/22/average-car-loans-are-now-much-bigger-than-the-vehicles-are-worth/#:~:text=A%20new%20study%20from%20J.D.,the%20same%20period%20in%202021.

- https://www.kbb.com/car-news/study-average-used-car-loan-now-125-of-cars-value/

- https://libertystreeteconomics.newyorkfed.org/2023/02/younger-borrowers-are-struggling-with-credit-card-and-auto-loan-payments/

- https://www.usatoday.com/story/money/personalfinance/2023/07/19/car-loans-harder-to-get-lenders-cautious/70425646007/

- https://www.coxautoinc.com/market-insights/auto-market-weekly-summary-june-26/#:~:text=Auto%20Loan%20Performance%20Deteriorates%20to%20Pre%2DPandemic%20Levels,-Auto%20loan%20performance&text=In%20May%2C%201.68%25%20of%20auto,back%20to%20at%20least%202006.

- https://gasprices.aaa.com/

- https://web.archive.org/web/20210121050022/https:/gasprices.aaa.com/

- https://www.cnbc.com/2023/06/20/credit-card-rates-stand-at-a-record-20point69percent.html

- https://www.experian.com/blogs/ask-experian/how-rising-interest-rates-impact-credit-cards/

- https://www.cnbc.com/select/how-credit-apr-is-affected-when-fed-raises-interest-rates/

- https://apnews.com/article/inflation-federal-reserve-system-business-afc9a9db9df9e2b5efd5dc74d1962909

- https://www.forbes.com/sites/adamminsky/2023/05/16/student-loan-interest-rates-set-to-skyrocket-for-many-borrowers/?sh=5030a0a4114c

- https://www.credible.com/blog/student-loans/student-loan-interest-rates/

- https://www.politico.com/news/2023/05/10/student-loan-interest-rates-increase-00096237

- https://www.nytimes.com/2022/08/24/us/politics/student-loan-forgiveness-biden.html

- https://budgetmodel.wharton.upenn.edu/issues/2022/8/26/biden-student-loan-forgiveness

- https://www.ntu.org/foundation/detail/cost-of-student-debt-cancelation-could-average-2000-per-taxpayer

- https://twitter.com/jasonfurman/status/1562503996270845953

- https://gop.com/research/bidenflation-brings-surging-interest-payments-rsr/

Support The Patriot Fund at https://patriotpost.us/donate